Catalyzing Indian MSMEs

with OCEN

(Open Credit Enablement Network)

With OCEN, the convergence of technology, regulatory support, and collaborative efforts is poised to propel the MSME sector towards unprecedented growth and resilience. OCEN isn’t just a financial infrastructure; it’s a catalyst for empowering the engines of India’s economy – its MSMEs.

Let’s delve deeper into the Open Credit Enablement Network (OCEN) and its potential impact on Indian MSMEs, opportunities and future implications.

The credit “gap” estimates range from the US $300 Billion as in the diagram above to over a Trillion dollars. In a study last year on MSME lending, investment banking company Avendus Capital estimated an astounding credit gap of $1544 billion in the MSME sector with a caveat that about 47% of this value was un-addressable as it came from sub-par performing enterprises. Even so, the estimated addressable credit gap was an astounding US $530 Billion.

Traditional lending systems, with their stringent collateral requirements and lengthy processes, often leave MSMEs locked out of the financial resources they need to thrive. Enter Open Credit Enablement Network (OCEN), a revolutionary initiative poised to unlock the immense potential of these entrepreneurial engines and propel India’s economic growth to new heights. This innovative financial infrastructure promises to revolutionize credit accessibility for MSMEs, potentially transforming their growth trajectory.

Untangling the Knots of MSME Lending: The Challenges:

For decades, Indian MSMEs have grappled with a credit crunch that stifles their growth. The roadblocks are numerous:

- Collateral Conundrum: Lack of formal assets often renders MSMEs ineligible for traditional loans, leaving them at the mercy of informal lenders with exorbitant interest rates.

- Paperwork Purgatory: The mountains of paperwork involved in loan applications discourage many MSMEs, who struggle to navigate the complex maze of documentation.

- Limited Reach, Unequal Access: Traditional lenders, often wary of perceived higher risks and operational costs, shy away from catering to MSMEs, leaving them financially ostracized.

- Data Desert Dilemma: Lenders lack access to reliable data about MSMEs, making it difficult to assess their creditworthiness accurately. This information asymmetry translates to limited trust and reluctance to lend.

OCEN to the Rescue: Redefining the Credit Landscape, Frictionless & Inclusive

India is charting a remarkable journey when it comes to DIGITAL INFRASTRUCTURE. Our success in UPI, Aadhar based KYC etc. are testimony to this technology lead. While most of these digital (public good) platforms have been enabling individuals, OCEN promises the same transformation in the B2B segment.

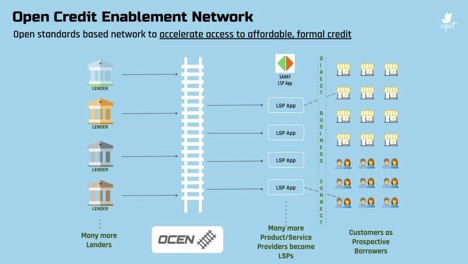

Imagine a network, not of wires and cables, but of data and trust. This is the essence of OCEN, a standardized, open platform that connects lenders, borrowers, and credit service providers through a common language of APIs (Application Programming Interfaces). This seamless communication eliminates the friction of traditional lending, paving the way for a more efficient and inclusive financial ecosystem.

The Genesis of OCEN: A Collaborative Endeavor

OCEN stems from the collaborative efforts between the Reserve Bank of India (RBI), the National Payments Corporation of India (NPCI) and iSpirit the non-profit think tank. It is a standardized, interoperable framework that reimagines the credit ecosystem, transcending traditional barriers and creating a more inclusive financial landscape.

Understanding OCEN 4.0 : Dissecting the Mechanism

OCEN is a protocol that allows platforms and markets called LSPs (Loan Service Providers) to link to banks and non-bank lenders to digitize the origination, underwriting, and servicing process of loans.

While the base set of protocols themselves are very powerful, in our opinion, the introduction of ESCROW mechanisms will be a game-changer. Imagine for a minute ESCROW mechanism not just being digitized, but, executed on milestones automatically with Blockchain enabled self-executing contracts.

Unveiling the Impact: Transformative Benefits for MSMEs

- Streamlined Application Processes: OCEN streamlines the loan application process, reducing paperwork and digitizing procedures, making credit more accessible to MSMEs.

- Data-driven Credit Assessment: Shared data among lenders enables more accurate credit assessments, enhancing the chances of MSMEs securing loans based on their creditworthiness rather than collateral.

- Competitive Interest Rates and Timely Disbursals:

- Competitive Interest Rates: The platform fosters a competitive environment among lenders, ensuring MSMEs access credit at competitive interest rates, driving down borrowing costs.

- Efficient Disbursals: Digitized processes expedite loan disbursals, enabling MSMEs to receive funds promptly, thereby enhancing their agility in seizing business opportunities.

- Reduced Administrative Burden and Risk Mitigation:

- Minimal Administrative Hassles: Standardized protocols and digitized workflows significantly reduce bureaucratic hurdles, simplifying the loan approval process for both MSMEs and lenders.

- Risk Mitigation: OCEN’s shared data framework aids in risk assessment, reducing the perceived risk for lenders when extending credit to MSMEs, thus promoting a more conducive lending environment.

Infact, as we’ve indicated earlier, OCEN, we believe will lead to innovative practices in both credit pricing (eg. Dynamic Discounting) and guaranteeing (Escrow). With time and access to data, we believe, all of MSME lending will address the working capital gaps with personalized solutions rather than “bracketed” solutions like (OD – Over draft, EPD – Early Payment Discounting) etc.

Beyond Credit: Unleashing the Potential of Indian MSMEs

The impact of OCEN transcends mere credit access, ushering in a wave of positive change for Indian MSMEs:

- Growth Engine: Easier access to finance fuels the growth of MSMEs, enabling them to expand operations, invest in new technologies, and create more jobs, contributing significantly to India’s GDP.

- Competitive Champions: Empowered with financial resources, MSMEs can compete more effectively in the market, boosting India’s global competitiveness and driving economic dynamism.

- Inclusionary Wave: OCEN brings formal financial services to previously underserved segments, promoting financial inclusion and reducing dependence on informal lenders and exploitative practices.

- Job Creation Catalyst: As MSMEs flourish, they create more jobs, alleviating poverty and fostering inclusive economic development.

Challenges and the Road Ahead: Bridging the GAP

While OCEN’s potential is undeniable, realizing its full impact requires addressing certain challenges:

- Silos of Control & Sanctions: The banking sector is very comfortable in its current avatar of the “gatekeeper” role – there is usually a single banker who evaluates and approves the working capital requirements of the MSME. This stranglehold needs to be broken for adoption.

- Awareness Gap: Both MSMEs and lenders need to be educated about OCEN’s benefits and how to utilize it effectively to bridge the awareness gap and drive adoption.

- Data Security Fortress: Robust data security protocols and stringent regulatory frameworks are crucial to ensure the safety of sensitive financial information in this data-driven ecosystem.

- Standardization Symphony: Continuous efforts are needed to refine OCEN standards and regulations across platforms and participants, ensuring a smooth, secure, and standardized lending experience for all.

Conclusion: Paving the Path for MSME Empowerment

OCEN stands at the cusp of transforming the MSME landscape in India, heralding an era of financial inclusivity and growth. As this innovative platform gains traction, it not only simplifies credit access but also catalyzes a paradigm shift, empowering MSMEs to drive economic resurgence and innovation.

In conclusion, the convergence of technology, regulatory support, and collaborative efforts is poised to propel the MSME sector towards unprecedented growth and resilience. OCEN isn’t just a financial infrastructure; it’s a catalyst for empowering the engines of India’s economy – its MSMEs.

As OCEN continues to evolve and expand its footprint, it holds the promise of reshaping India’s economic narrative by fostering an ecosystem where MSMEs thrive, innovate, and contribute significantly to the nation’s progress.